How Much Can Solo 401(k) Savers Put Away for Retirement? For those 50 or older, who choose to make an additional $6,500 catch-up contribution, that brings a maximum of $64,500 in 2021. The 2021 amount has increased by $1,000 from a maximum of $57,000 in 2020. On top of the $19,500, your employer can contribute an extra $38,500 to bring your account to a total of $58,000. One of the benefits of a 401(k) plan is that your employer may also contribute to your retirement savings, either through a match or as a nonelective contribution. Are Employer Contributions Going Up in 2021? Employees 50 or older can save an extra $3,000 as catch-up contributions to SIMPLE 401(k) plans. This figure has remained unchanged since 2015.

Employers must contribute to these plans, and employees must be fully vested, but the plans are easy to administer and also are not subject to annual nondiscrimination testing. SIMPLE 401(k)s are designed for small businesses with 100 or fewer employees. How Much Can SIMPLE 401(k) Account Holders Contribute As a Catch-up in 2021? In a nutshell, if you’ll be 50 in 2021, you’d need to contribute $2,166 per month or $541.50 a week into your 401(k) plan.

#Max 401k contribution 2021 full

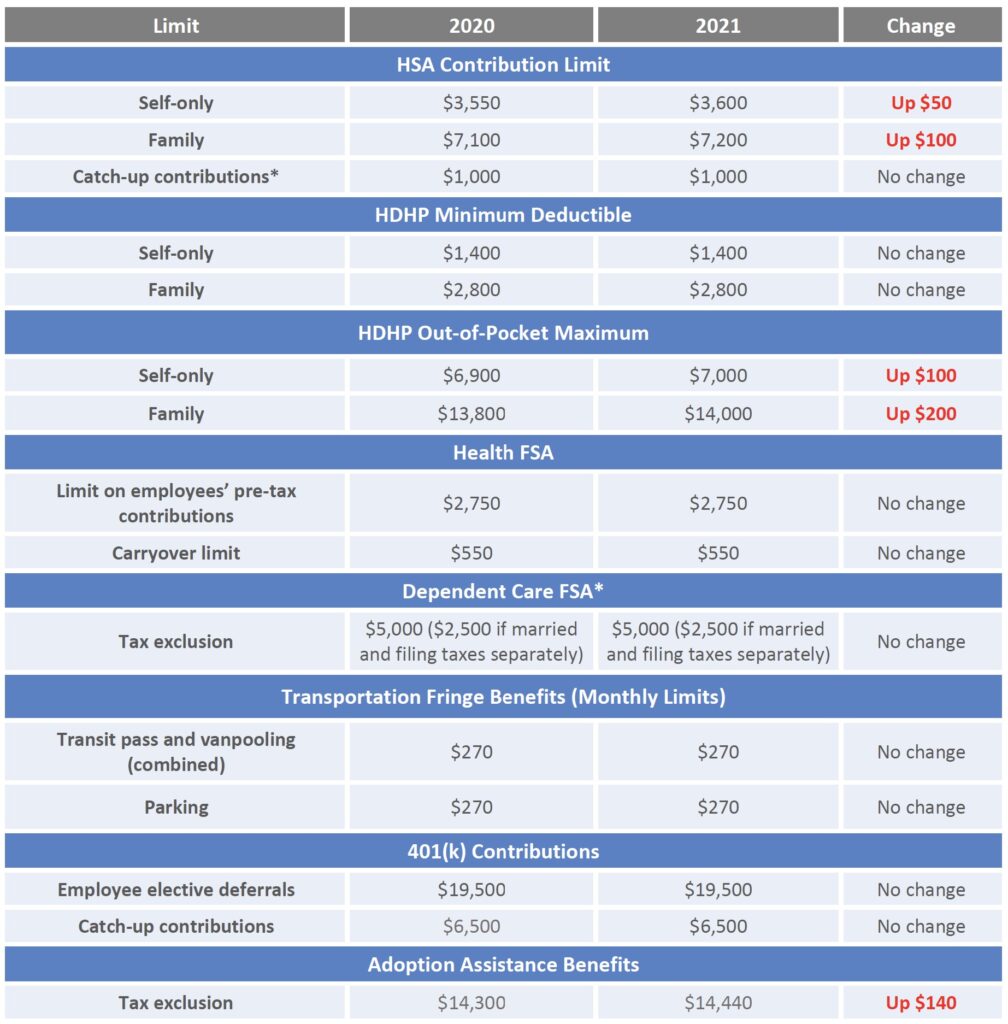

Earners making $100,000 a year would have to save more than a quarter of their pay to take full advantage of the catch-up contributions. It can be difficult for the average worker to put away $26,000 into a 401(k) plan. Nearly all 401(k) plans (98%) permit catch-up contributions, but, according to an analysis by Vanguard, only 15 percent of eligible participants take full advantage. How Much To Save To Maximize a 401(k) in 2021 The regular contribution limit also remains unchanged at $19,500 – which means, if you are turning 50 in 2021, you will be able to save up to $26,000 in a tax-advantaged retirement saving account. Unfortunately, NO! The 401(k) catch-up contribution limit for Traditional and Safe Harbor plans will remain unchanged at $6,5. Are 401(k) Catch-up Contributions Increasing in 2021? If you’ll be hitting that 50 milestone birthday in 2021, now is a good time to ensure your percentage is sufficient to reach the new maximum 401(k) contributions (including the catch-up contribution), so you can maximize your retirement savings. On top of that, you’ll be earning investment returns and compounding interest on the additional money saved. The tax deduction for a catch-up contribution can save you more than $1,000 on your annual IRS bill. In the year you turn 50, you become eligible to put aside more tax-shielded money into your 401(k) plan.

0 kommentar(er)

0 kommentar(er)